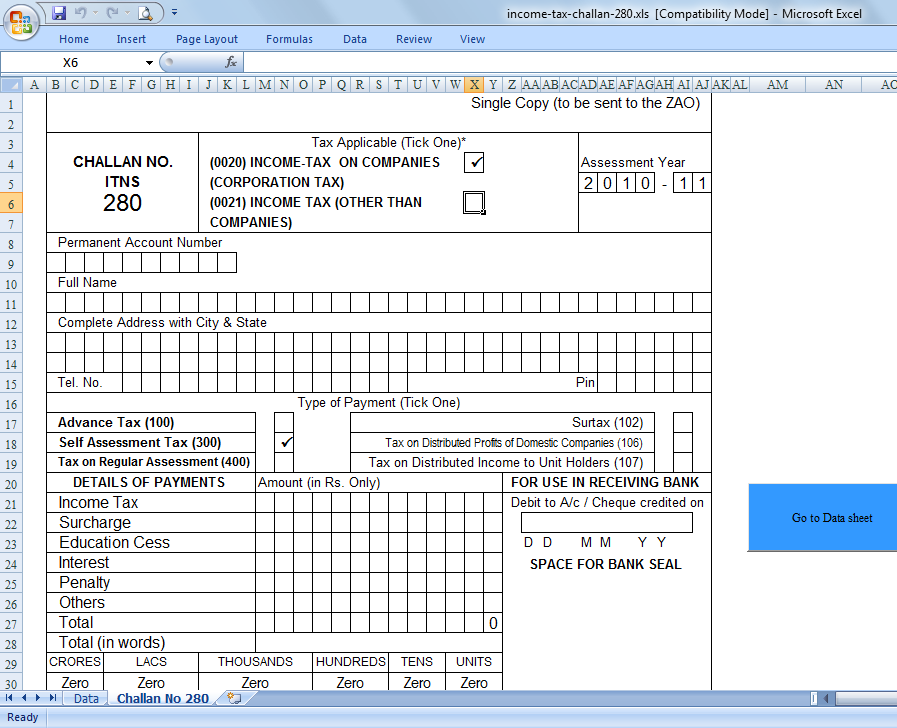

Pay your advance tax online in 5 easy steps Challan signnow excel How to fill challan 280 offline & payment of income tax

Challan 280 : Self Assessment & Advanced Tax Payment - Learn by Quicko

How to pay income tax that is due? Advance tax: details,what, how, why Challan pay apnaplan

Challan bank sap payment tax generation generate counter process across goods

Advance challan tax generateHow to pay online advance tax to income tax department using challan Challan tax income 280 payment fill offlinePay your advance tax online in 5 easy steps.

Itns advanceHow to pay advance tax (challan 280) through online ? Advance tax challan pay verify online steps easyHow to pay income tax challan offline|advance tax.

How to create an advance income tax challan

Create challan form crn user manual income tax departmentChallan quicko Income salaried employee sectionAdvance tax: concept & e-challan (itns-280) for payment.

Tax assessment self advance challan incomeChallan no. itns 281 tax deduction account Offline challan incomeProcess to generate challan on sap for payment across bank counter.

Challan 280 : self assessment & advanced tax payment

Free download tds challan 280 excel format for advance tax/ selfChallan 280 pdf editable: complete with ease Income challan receipt taxpayer bsr cleartaxChallan itns 280.

How to calculate and generate the advance tax challanChallan 280 itns tax income indiafilings Tds payment challan excel format tds challana excel formatChallan steps.

Challan 280 offline payment to pay income tax advance tax

Teachers and schools data info: how to pay income tax that is due?Challan calculate generate How to calculate and generate the advance tax challanDownload challan no itns 280 in excel format.

Download automated excel based income tax deposit challan 280 fy 2019Online tax payment: steps to pay income tax with challan 280 Pay your advance tax online in 5 easy stepsTax challan income assessment self code bsr due number pay select taking guide our.

Challan cleartax

Challan 280 itns excel incomeWhat does fw mean on a receipt How to pay advance tax income tax using 280 challanHow to pay advance income tax online for salaried employee.

How to calculate and generate the advance tax challan → kdk softwaresView challan no. & bsr code from the it portal : help center Challan 280 tax form income payment online payAdvance tax due date for fy 2023-24.

Income tax

Tds tcs advance income tax challan generation .

.

ADVANCE TAX: Concept & E-Challan (ITNS-280) For Payment - YouTube

CHALLAN NO. ITNS 281 Tax Deduction Account | Payments | Debit Card

Advance Tax Due Date for FY 2023-24 | AY 2024-25

Challan ITNS 280 - IndiaFilings - Learning Centre

How to pay Income Tax Challan Offline|Advance Tax | Self Assessment Tax

How to calculate and generate the Advance Tax Challan